- Moving the market

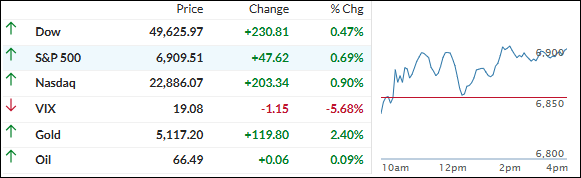

Stocks opened strong and kept the positive momentum going most of the day, with traders shrugging off recent AI disruption fears.

The real spark came from AMD jumping 7% after Meta announced a multiyear deal to deploy up to 6 gigawatts of AMD GPUs for its AI data centers. Meta’s also taking a performance-based warrant for up to 160 million AMD shares.

That news gave the chip and software space a nice lift, especially after last week’s heavy selling.

The broader market stayed upbeat thanks to some encouraging macro data—home prices held steady (helping affordability), and consumer confidence rebounded.

Yesterday’s software meltdown took a breather, and a massive short squeeze (the biggest of the year) fueled the upside in small caps, which led the pack.

Bond yields stayed steady, rate-cut expectations eased off a bit, and the dollar ended only modestly higher.

Metals took a little breather—gold dipped to $5,100 but used it as a springboard to hold firm.

Bitcoin dumped overnight but found support at $63K and recovered some ground.

All eyes are now on Nvidia’s earnings report tomorrow—it could set the tone for the AI trade heading into the rest of the week.

Read More